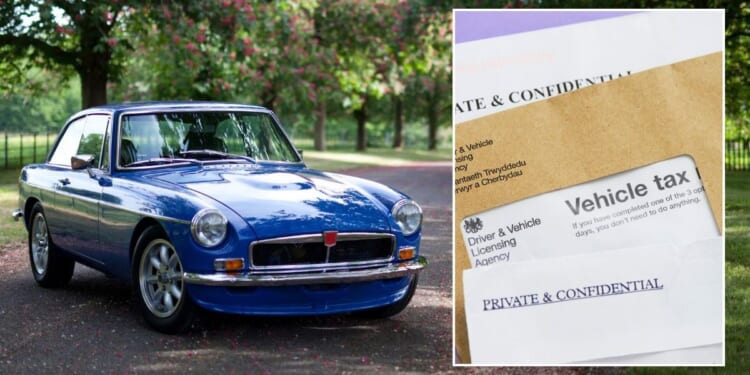

Classic cars aged over 40 years will continue to remain exempt from paying Vehicle Excise Duty, ending months of uncertainty for owners and the heritage motor industry.

The Autumn Budget confirmed that the long-standing tax relief for vintage vehicles would be maintained, despite a host of other tax changes.

The confirmation comes as the Government prepares to implement pay-per-mile charging for electric and plug-in hybrid vehicles from April 2028.

The exemption applies to more than 350,000 vehicles among the 1.6 million classic cars and motorcycles currently on the roads.

Mark Roper, managing director of Hagerty UK, said: “Along with the announcement that a freeze on fuel duty will continue, this is very welcome news for classic car owners and for an industry that contributes over £3billion in direct taxes to the UK economy every year.”

Classic car status typically begins when a vehicle reaches 25 years of age, encompassing models from the 1980s, 1990s and even the early 2000s.

The announcement brings relief to an industry that has faced months of speculation about potential changes to the historic vehicle tax regime.

Dale Keller, CEO of the Historic and Classic Vehicles Alliance, welcomed the decision, saying: “Preserving the exemption aligns with the Government’s wider environmental goals through maintaining vehicles whose lifecycle carbon impact is negligible compared to the manufacture of new vehicles.”

Classic cars will remain exempt from VED if they are older than 40 years, as well as MOT checks

|

GETTYHe noted that classic vehicles are typically used sparingly as cherished examples of industrial and design heritage.

The heritage vehicle sector represents a significant economic force, with the Alliance reporting an industry worth £7.3billion that generates over £3billion in direct taxes annually.

Research indicates the sector supports approximately 113,000 jobs across thousands of specialist small businesses and supply chain firms.

Mr Keller added: “Research suggests classic vehicles are used sparingly as cherished items of industrial and design heritage.

“The tax contribution of the vehicles was made decades ago, and applying the VED would be disproportionate to their use, which was the key factor in the exemption being applied in the first place.”

Reports revealed that 350,000 vehicles will be exempt from paying the pay-per-mile charge

|

GETTYThe Chancellor also confirmed that classic vehicles will maintain their exemption from annual MOT testing, though she emphasised this policy would remain under review for the coming years.

This continuation of the MOT exemption has sparked mixed reactions within the classic car community.

“Many organisations would like to see an annual roadworthy test for older vehicles, and many classic vehicle owners choose to continue with a yearly MOT test despite exemption, as being assured of their continued roadworthiness is something to be welcomed,” Mr Roper noted.

The dual exemptions from both VED and MOT requirements represent significant savings for owners of qualifying vehicles, though the Government has indicated it will monitor the MOT policy’s effectiveness.

Drivers are exempt from paying tax on classic cars if they are over 40 years old | CAR AND CLASSIC

Drivers are exempt from paying tax on classic cars if they are over 40 years old | CAR AND CLASSICThe Budget introduced significant changes to car tax, with electric cars incurring a charge of 3p per mile in 2028, with plug-in hybrid owners paying 1.5p per mile, alongside the standard EV road tax rate of £195.

An extension to the temporary 5p fuel duty will remain until September 2026, after which rates will gradually return to March 2022 levels through staged increases.

Simon Williams, RAC head of policy, welcomed the fuel duty freeze: “Drivers will be relieved the Chancellor has decided to keep the 5p duty cut in place for now as it saves them more than £3 a tank.”

From early 2026, all petrol stations must report prices to the Government’s Fuel Finder scheme, enabling motorists to locate cheaper fuel options.