“S&P 500 ekes out sixth winning day as investors look past U.S. credit downgrade,” reads the CNBC headline after today’s stock market close.

In my opinion, this is not something investors should look past. Late Friday, Moody’s announced a downgrade in America’s credit rating from triple-A to double-A (Aa1, in their nomenclature).

And with good reason, America is $37 trillion (with a “t”) in debt, with an annual deficit running more than $2 trillion a year.

Around $4 trillion of the debt was accumulated in a questionable effort to “fight” Covid. But another $6 trillion was added under Joe Biden for no particular purpose.

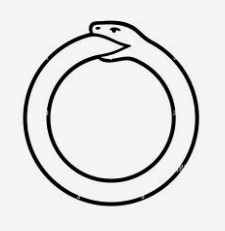

Of the annual Federal budget, more than $1 trillion is going to pay just the interest on that debt. In mythological terms, it’s the Ouroboros, the snake eating its own tail: we are consuming ourselves.

This can continue for some time, with no apparent ill effect, but not forever.

In the meantime, the market was up for the sixth trading day in a row, and the 17th of the past 20 trading days, dating back to April 21.

Rasmussen has Pres. Trump’s approval rating on level terms, 49-49, continuing the May streak at or above parity.