More people in the UK are looking to trade and invest than ever before, with around 2.75 million adults now using online platforms to do so, according to Investment Trend’s 2025 report.

However, recent analysis from Blackrock suggests around 62 per cent of adults in Britain are still not investing at all; an issue STARTrading CEO Lewis Crompton is looking to address.

Mr Crompton founded his business in 2019, offering online trading education and mentorship to budding British investors, using his experience as the template for future traders.

The entrepreneur spoke with GB News about StartTrading’s origins, his business success, challenges, and frustrations with the current tax regime for investors under Chancellor Rachel Reeves.

The trading expert is sharing insight to budding investors through his successful business

|

STARTrading

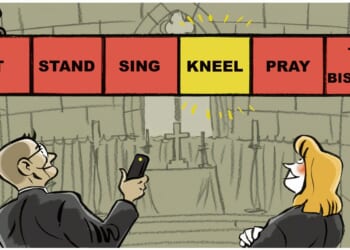

When Mr Crompton talks about his career, he jokes that he’s “lived a few lives”. This is only half a joke. Before founding StarTrading, he was ordained as a minister in the church.

That instinct to help people never left him. However, after stepping away from the church and losing his income as a therapist, the young man found himself starting again in retail.

He worked his way up from the shop floor into head office, only to realise the corporate ladder led somewhere he didn’t want to be: “I wasn’t helping people anymore, and I knew this wasn’t the life I wanted.”

Mr Crompton’s path into financial markets was not planned. It began with what he describes as a mistake: signing up for the wrong course at a Robert Kiyosaki’s Rich Dad seminar. Instead of property investing, he found himself learning about trading financial markets.

He paid around half his annual salary for training, putting it on a credit card and a loan. A few months later, he quit his job and spent a year travelling the world, trading along the way. The company that trained him later invited him back to teach, where he spent several years refining his approach.

STARTrading now operates globally

|

STARTrading

Six years ago, Mr Crompton decided to strike out on his own. StarTrading Now was born with a simple aim: help ordinary people learn how to trade in a clear, structured, time-efficient way.

Within three years he had made his £1million, and he now runs a successful education body teaching everyone from housewives to teachers how to trade the markets, in just half an hour a day.

StarTrading Now did not explode overnight. In fact, Mr Crompton never expected it to grow at all. He explained: “I make my money from my own investments,” he explains. “I didn’t need the business to survive. I just wanted to help people.”

Despite this, word spread. Students began seeing results. Demand grew. Mr Crompton realised that to help more people, he needed to build a team — and that meant becoming a business owner in earnest.

Some milestones stuck with him. The first £100,000 year felt huge. Then came £100,000 months. Then £100,000 in weeks. Growth snowballed, largely driven by referrals and a strong sense of community, something that proved invaluable when the pandemic hit.

On Covid’s impact, the entrepreneur added: “Lockdown actually helped us build connections. People were isolated and looking for community. That culture has stayed with us.”

Today, StarTrading Now operates worldwide, with students across multiple countries, while still retaining what Mr Crompton describes as a “community-first” approach.

His ambitions extend well beyond online education. Long-term, he wants to grow StarTrading Now into a fully regulated financial operation, one that could fund talented traders and offer better returns to savers than traditional banks. That ambition, however, collides with reality in the UK.

“It’s easy to start a business here,” Lewis says. “It’s incredibly hard to scale one.” He points to taxation as the biggest barrier. VAT, corporation tax, employer National Insurance, pension contributions , all before he can pay himself. Whatever remains is then taxed again through dividends, potentially at rates approaching 41 per cent.

On the tax burden, Mr Crompton noted: “When you’ve worked flat-out for a year, trying to grow something meaningful, it’s demoralising to see so little left at the end, It limits how fast you can hire, invest and scale.”

While he accepts the need for regulation and tax to protect workers and consumers, he believes the balance has tipped too far: especially for small and medium-sized businesses.

Rachel Reeves delivered the Budget in the Commons on November 26 | PA

Rachel Reeves delivered the Budget in the Commons on November 26 | PAThose pressures are shaping Mr Crompton’s next move. While StarTrading Now will remain UK-based, he plans to become personally tax-resident in Greece, where the final tax burden on income is significantly lower.

He explained: “It’s not about dodging responsibility. It’s about choosing a system that doesn’t punish you for building something. If dividend tax were lower, people would stay. High taxes don’t bring loyalty. Fair ones do.”

STARTrading’s founder believes policymakers in Westminster underestimate how mobile entrepreneurs have become — and how sensitive they are to signals from government.

For those looking to start investing, why should they consider Mr Crompton’s business to kickstart their journey? His response: “My elevator pitch is simple: I show people how to trade financial markets tax-free in the UK, in under 30 minutes a day, in a way that can double their capital in 12 months.”