John Spry is Professor of Finance at the Opus College of Business of the University of St. Thomas in St. Paul. His expertise includes state and local public finance. With Minnesota Governor Tim Walz’s announcement yesterday that he seeks a third term, Professor Spry has attempted to assess Walz’s claim of “cutting taxes for the middle class” against the publicly available record. His analysis demonstrates the difficulty of putting Walz’s claim to the test. He emphasizes: “The views expressed here are solely his own. All errors are his own.” Professor Spry writes:

* * * * *

How has Governor Tim Walz changed taxes for middle class Minnesotans? The citizens of Minnesota deserve a clear, precise, and complete answer to this question. As he runs for reelection, Walz claims that he has been “cutting taxes for the middle class.” Media reporting, such as the following passage from The Star Tribune, fails to scrutinize this claim and instead muddies the waters with a list of tax changes omitting increased income and payroll taxes:

Walz also touted passing a new child tax credit and “cutting taxes for the middle class” in his campaign video.

Walz’s website cites tax rebates for nearly 1 million Minnesotans that tallied up to $1,300 for larger families. The Legislature under Walz also eliminated a state tax on Social Security benefits for many seniors.

Republicans argue Walz should have done more to cut taxes with a historic $17.5 billion state surplus in 2023, when Democrats controlled the House and Senate.

At one point, Walz proposed more generous tax rebates during the 2023 legislative session. GOP lawmakers also pitched much bigger rebates with the surplus.

Republicans and some Democrats advocated to fully eliminate the state tax on Social Security benefits, something Walz opposed.

That year, Democrats approved a tax plan that included roughly $4 billion in tax cuts, credits and expenditures over two years, while also raising more than $1 billion in tax increases in that time period and more later on.

Democrats hiked the state gas tax, passed a new fee on deliveries over $100 and implemented a metro-area sales tax increase to fund transit projects.

Under TAX CUTS FOR WORKING FAMILIES AND THE MIDDLE CLASS, Walz’s official site claims:

Governor Walz has cut taxes with every one of his budgets. Governor Walz has delivered a variety of rebate checks up to $1,300 to seniors, students, workers, and middle-class families. He also lowered taxes for small businesses and fully exempted state taxes on social security for more than three quarters of seniors.

A precise accounting of Governor Walz’s complete record on taxes could and should be obtained by the Senate Tax Chair or a House Tax Co-Chair requesting a tax incidence analysis from the Minnesota Department of Revenue (DOR) of all tax provisions of all bills changing Minnesota state and local taxes that Walz has signed into law or authorized with his signature since 2019.

My review of some prior Tax Incidence Analysis by the DOR casts doubt on Walz’s claim of middle class tax cuts. Let’s examine and add up the existing DOR tax analysis of the significant bills with tax provisions from the 2019 legislative session, when there was a DFL House and GOP Senate, and most of the 2023 tax provisions in major bills with tax provisions when there was a DFL House and Senate. There are other tax bills in different years of Walz’s tenure, but Minnesota has a biennial budget process, and these are the years with the most significant tax changes.

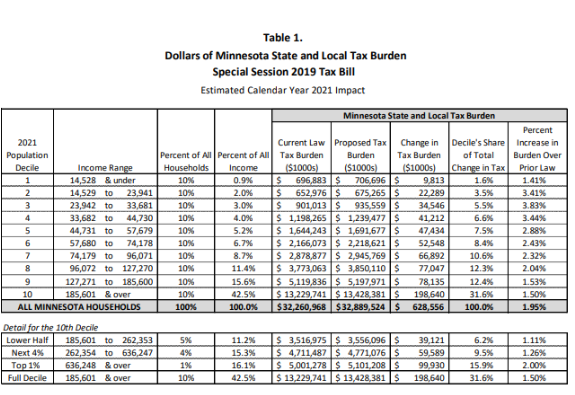

The DOR tax incidence analysis for the 2019 bills with tax provisions shows small across-the-board percent increases in tax burden over the prior law for all population deciles.

Source: 2019 DOR analysis, at 3.

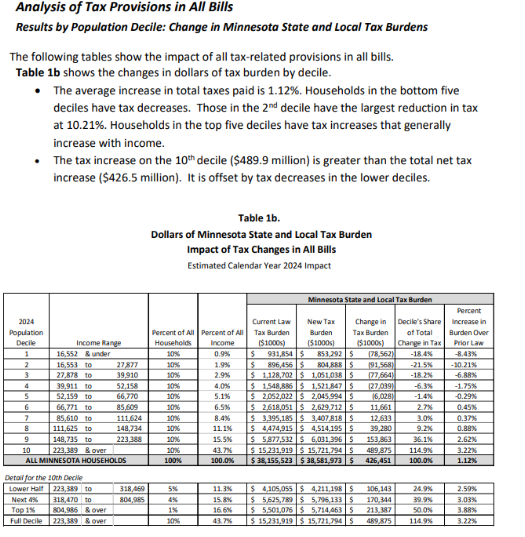

The DOR Analysis of most provisions of all bills with tax provisions in 2023 shows the 1st to 5th population deciles having a tax cut and the 6th to 10th population deciles having a tax hike. This is the result of larger targeted tax expenditures, like the new child tax credit that gradually phases out with income over $31,090 on a single return or on $36,880 joint return. So the income range below $66,770 is shown as having a tax cut resulting from most of the 2023 tax provisions by leaving out the new 0.88% payroll tax to fund the paid leave program. This is the DOR justification for omitting the new 0.88% payroll tax: “Paid family leave premiums in Chapter 59 are not included, since they are considered insurance premiums rather than a tax.” 2023 DOR analysis, at 3.

Source: 2023 DOR analysis, at 11.

When the Legislature and former Gov. Pawlenty called the 2005 tobacco tax hike a health impact fee, the DOR produced a tax incidence analysis with the fee in addition to an analysis without it. 2009 DOR study, at 64. The Department of Revenue should follow its precedent and produce a tax incidence analysis that includes the new 0.88% payroll tax.

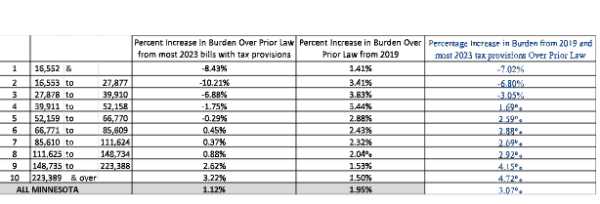

The column on the right presents the author’s calculation. It adds up, by population decile, the two Department of Revenue tax incidence analyses of many (but not all) of the tax changes in legislation that Governor Walz has signed. It is not an analysis of all of the tax changes made by Walz. The middle two population deciles, the 5th and 6th deciles, have a small tax increase of just over 2.5% in this incomplete calculation.

Minnesota deserves better than the incomplete table above. The Minnesota Department of Revenue should produce a tax incidence analysis of all Walz’s tax changes.

FOOTNOTE: “The effective tax rate for the 1st decile is overstated for several reasons. First, the lowest decile includes households who have temporarily low incomes or have better overall economic well-being than was indicated by their money income in 2021. A portion of retirees, for example, may be living primarily on savings or other assets but report small amounts of annual money income received. Due to unemployment or business fluctuations, some households who normally have higher incomes are also included in the 1st decile. A small portion of all 1st decile households were in this decile only because they reported business losses or large capital losses for income tax purposes in 2021.” 2024 DOR study, at 14.